| The purpose of writing this article is to bring to light a very important investment avenue-which has

so far been ignored by retail investor- liquid funds offered by mutual funds. Investors still continue to

park their surplus cash in savings bank accounts while shying away from a more remunerative option,

viz liquid fund .As per AMFI of the Rs 2.2trilion parked in liquid funds retail investment constituted

less than 1% share while the rest was shared by banks, FI and HNI's..

What Are Liquid Funds?

Liquid funds are mutual fund schemes where the primary objective is to invest in debt instruments

with maturities of less than 91 days, generating optimal returns while maintaining safety and high

liquidity.

Liquid funds primarily invest in money market instruments such as Certificates of Deposits (CDs),

Commercial Papers (CPs) and Government Treasury Bills. Such a portfolio helps liquid funds provide

high liquidity to investors. Accordingly, redemption requests are processed within 24 hours.

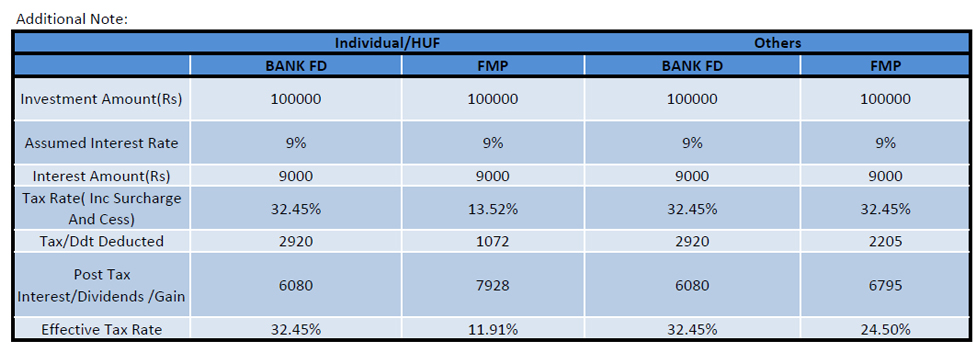

The 3 tables will help you understand better. |